Everybody wants free money, right? For prospective and current college students the Free Application for Federal Student Aid (FAFSA)is the opportunity to gain the financial support that may impact their future indefinitely.

The 2024-25 FAFSA form has been expected to receive updates since [some date] but it was not known when this year’s form would be opened for completion. It was said by most reporters to open “sometime” in December.

Although soft launched on Dec. 31, most students struggled to access the form. When trying to open the website students were met with a message notifying them that they have been entered into a digital wait line, similar to competing for concert tickets.

Some students were constantly checking the site hoping for updates and access to the form because some colleges have different deadlines than the general FAFSA form.

“I applied early for USC so I had to file FAFSA by the 12th of January, it was barely open and I could only access it for an hour,” senior Marlene Garcia said.

In 2020, Congress passed the FAFSA Simplification Act, which is exactly what it sounds like. An initiative to not only make the form shorter, but also easier to complete. This would require several years of work to rewrite the FAFSA process, as well as the form itself, which was shortened from 108 questions to 46.

The new form is meant to be more generous to low-income students. One way of achieving this is by limiting what income is considered in aid math, but these issues were not solved completely.

For example, Income reports were supposed to have been updated and adjusted based on inflation rates, which have changed drastically just since the FAFSA Simplification Act was passed in Dec. 2020. But the changes were not made, which results in less aid for many students because the calculations do not match current financial living standards. This will not negatively affect the lowest income brackets, but those mainly those just above this standard will have access to far less financial aid.

“It [the flaw] is a bummer that I’m hoping is going to be fixed once financial aid packages come to each student from the[ir] college,” College and Career advisor Natalie Debbas said. “… but I can’t tell you for sure [what they will do].”

The U.S. Education Department plans to rectify this change for next year’s form, but they do not have a clear and solid plan as to when and how these changes will be implemented. The department is avoiding fixing the problem this year because they believe that it would be more disruptive than helpful due to how behind the form is.

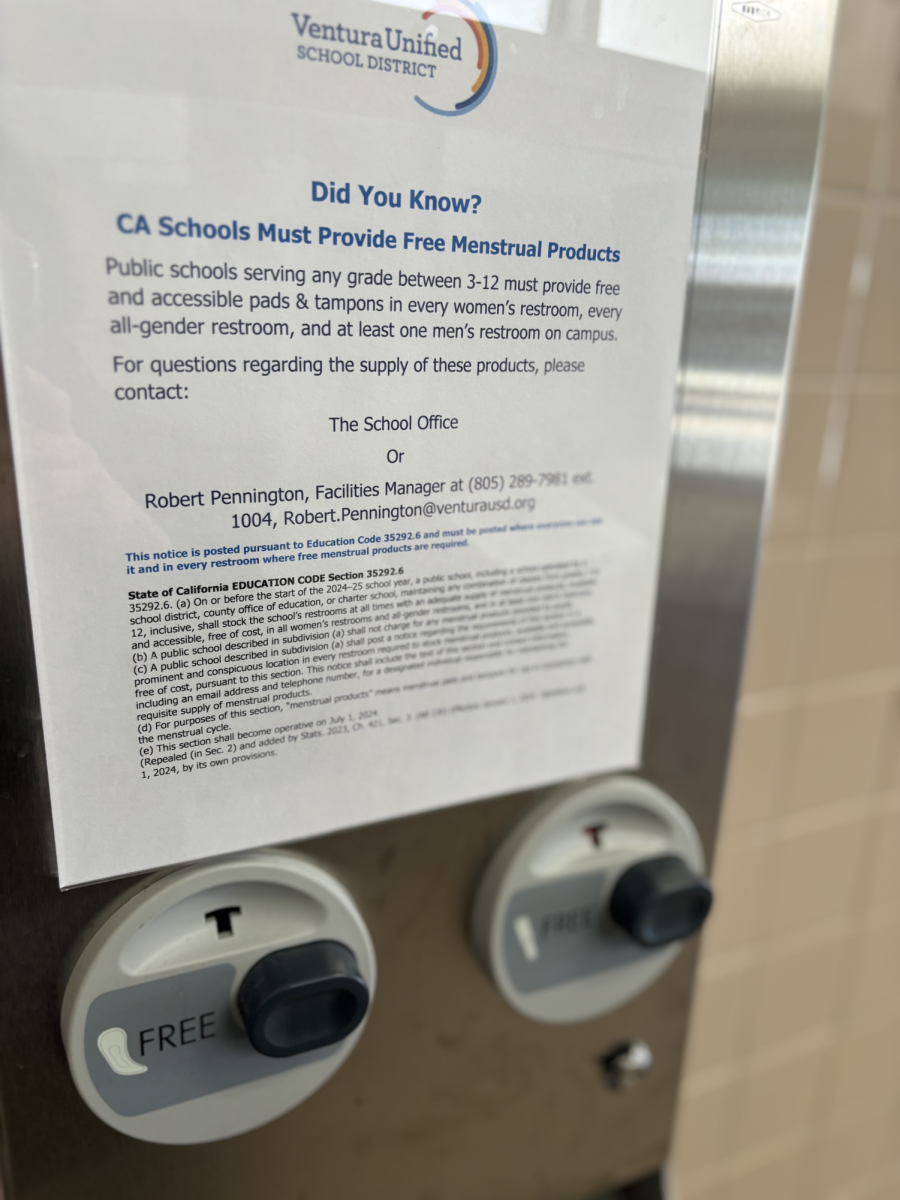

Starting with this year’s FAFSA form, any person who contributed to your form can create an account at StudentAid.gov, even if they do not have a social security number. Although, this too, has been an issue.

“One of the biggest [problems] is students or parents with no social security number are not able to continue on with the FAFSA, they are getting stuck,” Debbas said.

This year’s form also requires both you and your contributors to consent and approve the IRS transfer of federal tax information into the form; even if they don’t have an SSN, didn’t file a tax return, or did so in another country.

Another change this year is the Student Aid Index (SAI) replacing Estimated Financial Contribution (EFC). Previously, EFC would decide how much money a student required based on the many income-based questions on the form. Starting this year, The SAI will be the new important number. The SAI ranges from 1500 to 999999 and serves more as a range/gauge than a dollar amount.

Through FAFSA students can receive eligibility for the Federal Pell Grant. This year’s eligibility has been expanded to allow more students the opportunity to earn the grant.

However, as beneficial as this change may be in the long run, it is becoming clear that the issues this year are disrupting that good intention. The lack of information available has been especially challenging. For example, when Debbas attended the California Student Aid Commision’s Annual statewide Financial Aid Workshop, there were many questions that even the CSAC professionals did not have answers to.

“They [college and career advisors] didn’t know what information to give because they didn’t even know what was going to change,” Garcia said.